Do You Know the Benefits of CFD Trading?

CFD (Contract for difference) is currently being employed by many Forex traders throughout the world, owing to the benefits the package offers its consumers. Clearly said, the product permits you to profit on the difference between the selling and buying prices. You could also trade stocks at any time because the product does not require you to wait long to earn money. If you look hard enough, you can find a programme that allows you to trade CFDs and stocks within the Best Cfd Trading Platform.

Possibly the most significant advantage of CFDs is the ability to profit whether markets are rising or falling. It implies that when you use CFDs, you could trade both short and long positions, and based on your broker, you can make good gains even while everyone else is grumbling about the awful market circumstances. Whenever it comes to utilizing a CFD, there are no restrictions on the quantity of shares you could trade, giving you the opportunity to trade whatever you want. Furthermore, the initial investment is little.

The notion that you are able to trade whenever you choose signifies that the product gives you flexibility because you can trade even when markets are shut. If you pick a solid CDF provider, you could trade at any time of day or night, which means you won't have to worry about it throughout the day when you're at work. You also won't have to be concerned about expiries because you'll be able to make trades at any time.

CFDs also feature lower transaction fees as compared to other stock trading methods. For example, there aren't any stamp duty expenses involved, which minimises costs, particularly when major transactions occur, which could also cost you a lot in stamp duty.

There is also an option of automatic stop loss that allows you to avoid losses at any time. Because it is automatic, you do not have to follow trades all day because you start giving it the order and then it will stop, making risk management very simple with this trading.

The Most Important Steps to Selecting A Cfd Trading Platform– The primary steps that can assist a trader in making a beneficial selection for a successful Cfd Trading For Beginners platform are as follows:

The trading platform must allow the investor to deal on the world's trading platforms 24 hours a day, seven days a week.

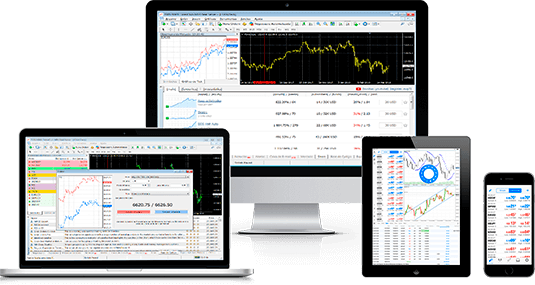

The Cfd Trading Brokers platform must feature a customizable interface that allows for easy access to a diverse range of marketplaces dealing in Forex, stocks, indices, & commodities.

The CFD programme must have features such as backup and assistance to allow the investor to optimize his earnings with simplicity.

The Indices CFD Trading platform must provide full functionality and convenience of use, allowing the investor simple and efficient access to the stock market of his or her choosing.

The trader must guarantee that the CFD platform allows the evening trade for a stop loss or limit order to be made in the evening.