Potentially Profitable: Investigating CFD Trading Deposit Bonuses.

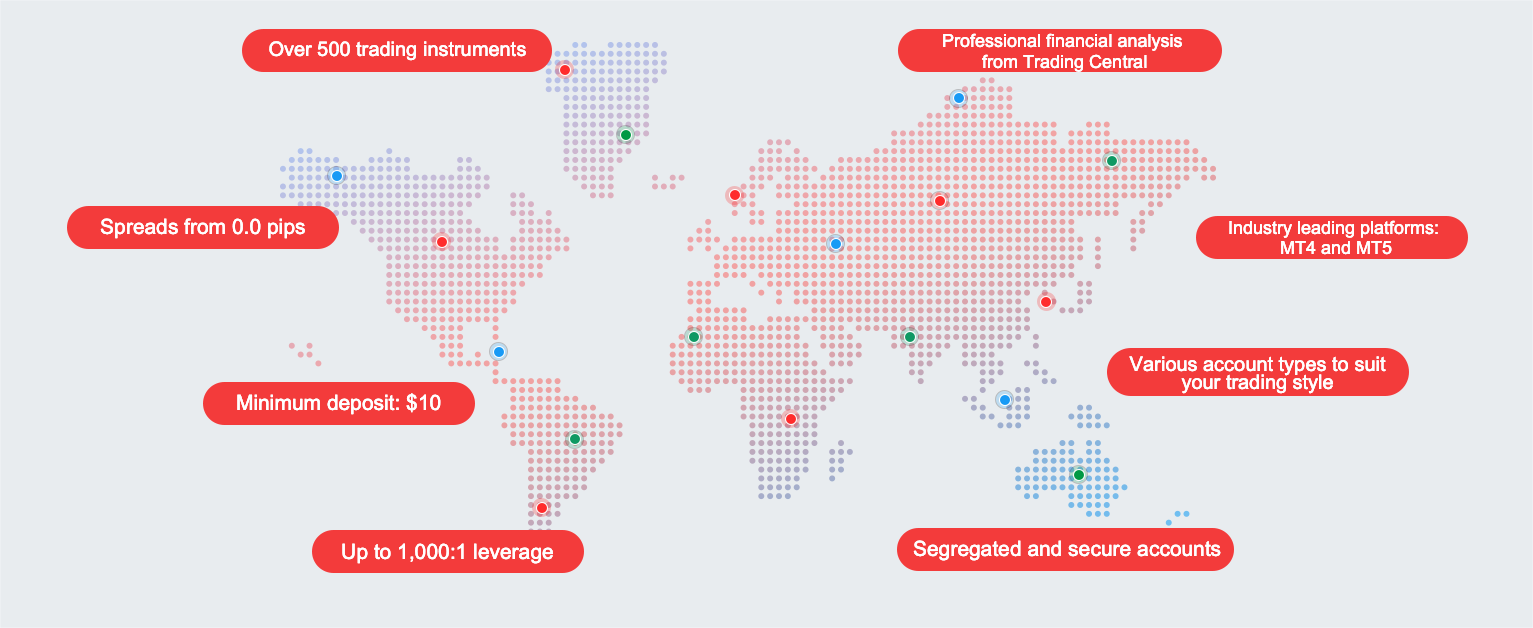

Contract for Difference (CFD) trading has evolved as a dynamic way for individuals to interact with a wide range of assets, from equities to commodities, in the exciting environment of financial markets. As traders negotiate this complex landscape, they are frequently presented with an attractive inducement in the form of a bonus on deposit. This article goes into the realm of CFD trading deposit bonuses, explaining its function and the benefits they provide to traders.

Understanding CFD Trading Deposit Bonuses

Trading platforms give deposit bonuses as a strategic offering to entice and reward traders in the context of CFD trading. When a trader makes a deposit into their trading account, the broker may provide them a bonus in the form of more trading money. Bonus on deposit always plays an important part. This bonus is an extra resource for traders to use in their transactions and can range in value depending on the percentage of the initial investment.

Deposit Bonus Types and Workings

There is a wide variety of deposit incentives available, each tailored to a certain set of market conditions and trader preferences.

The first type of bonus is the Welcome Deposit Bonus, which is given to new traders after they have created an account and made their first deposit. As a result, they have more money available for trading and may start exploring the platform's features right away. You can easily find the best deposit bonus from these platforms.

Targeted at current traders, the reload deposit incentive serves to maintain activity. Bonuses on consecutive deposits are given to traders to ensure that their trading capital is always growing.

The many ways in which a trader's experience and outcomes might benefit from deposit bonuses in CFD trading include the following.

- The most noticeable advantage is the increased trading capital. Traders who have access to bonus cash might take on riskier, possibly more lucrative bets.

- Risk mitigation strategy number two: bonuses absorb shocks. These supplementary funds can be used by traders as part of a comprehensive risk management strategy to safeguard their core investment money.

- Deposit bonuses allow traders to explore and experiment with numerous asset classes, trading methods, and tactics without having to risk their own money.

- Traders with a larger capital basis may experiment with additional trading strategies, time frames, and market circumstances.

- Traders who know they have access to bonus cash are more likely to have a positive frame of mind and trade well, even when market conditions are less than ideal.

In conclusion, CFD trading deposit bonuses provide traders with an opportunity to expand their financial reach, better control their exposure to risk, and discover previously inaccessible markets. While it's easy to see the benefits, realising them requires a cautious approach, a firm grasp of the concepts, and deliberate application. The dynamic world of CFD trading may be navigated with more ease and success by traders who learn to make the most of deposit bonuses.